Investing in Ohio’s Future: Groundwork Ohio’s Testimony on House Bill 96

- Mar 11, 2025

- 6 min read

Updated: Sep 8, 2025

Lynanne Gutierrez

Follow Lynanne on LinkedIn.

Note: the following proponent testimony for Ohio House Bill 96 was written and delivered by Lynanne Gutierrez before the Ohio House Finance Committee on March 11, 2025.

Chair Stewart, Vice Chair Dovilla, Ranking Member Sweeney, and members of the

committee, thank you for the opportunity to speak today. My name is Lynanne

Gutierrez, and I serve as the President and CEO of Groundwork Ohio. We are the

state’s leading early learning and maternal and young child health advocates, focused

on the healthy development of young children, prenatal-to-five, and their families. We

work with policymakers, business and community leaders, early childhood

professionals, and families to advance policies that support the healthy development

of young children to build a more prosperous future for Ohio.

We are testifying today because access to affordable, high-quality child care is not

just a family issue—it is an economic issue that affects businesses, workforce

participation, and the future prosperity of our state. Parents across Ohio are

struggling to balance work and child care, often facing difficult choices that impact

their ability to stay employed and financially stable. At the same time, child care

programs are facing challenges in sustaining their businesses and meeting the

growing demand for care. Without meaningful policy action, Ohio risks exacerbating

labor shortages and hindering economic growth. That is why we strongly support

expanding publicly funded child care and enacting a refundable Child Tax Credit

to provide much-needed relief to working families as proposed in House Bill 96.

Ohio families are working harder than ever to provide for their children, yet too many

are still struggling to make ends meet. Rising costs and financial uncertainty have

made it increasingly difficult for parents of young children to stay in the workforce

and contribute to our economy. The numbers tell a clear story:

More than a third of parents with children five and younger (34%) report serious problems paying their rent or mortgage. Nearly half (47%) are struggling to pay their credit card bills. These are hardworking Ohioans trying to do the right thing, but they’re finding it increasingly difficult to get ahead.

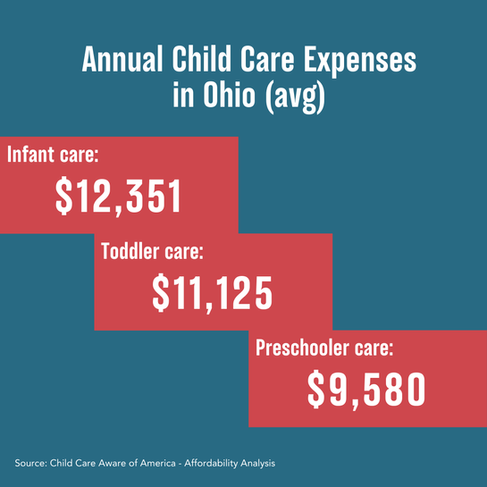

Child care is a key driver of this financial strain. Almost half of parents (49%) say child care is difficult to find, and a staggering 73% agree that child care is simply too expensive. It is now one of the biggest expenses a family faces—exceeding the cost of housing or in-state college tuition.

Ohio’s publicly funded child care program currently provides assistance to working

families earning up to 145% of the Federal Poverty Level (FPL). Only families who are

employed qualify for assistance. The proposed expansion in HB 96 would increase

eligibility to 160% FPL, ensuring more working families can access high-quality child

care. Additionally, the proposal supports the Child Care Choice Voucher Program,

which would provide assistance for families earning between 161% and 200% FPL.

This expansion ensures that more parents remain in the workforce while supporting

the economic stability of child care programs in a fiscally responsible way.

Ohio’s economic future depends on a strong workforce. But today, too many parents

are being forced to make impossible choices.

These disruptions are not just personal hardships—they have a direct impact on Ohio’s

economy, exacerbating workforce shortages and slowing economic growth.

We know that investing in early childhood development is one of the smartest

decisions we can make for our state’s long-term economic success because high-quality early childhood education is the foundation for kindergarten readiness,

ensuring children enter school prepared to learn and thrive. Unfortunately, most Ohio

children are not ready to learn when they begin school (65% of all children), and this

increases to 79% of low-income children. The disparity between low-income children

and their higher income peers exists in every county in the state. Children who

participate in high-quality early learning programs are more likely to be kindergarten

ready, graduate from high school, and contribute to a stronger workforce in the

future. Simply put, today’s child care investments not only support families and the

workforce of today, but shape the workforce of tomorrow.

Ohio has an opportunity to respond to what families are asking for, and Ohioans—

across party lines—want us to act. Nearly 9-in-10 Ohioans (84%) believe the state

should increase funding for child care to increase access, affordability, and quality.

Notably, this support includes 77% of Republicans, 84% of Independents, and 92% of Democrats. They recognize what so many Ohio parents already know: when families

have access to reliable child care, they work more, earn more, and contribute more to

their communities.

Expanding publicly funded child care is the most direct and effective way to support

working parents and ensure that Ohio businesses have the workforce they need. A

robust child care infrastructure allows parents to reenter the workforce, increase their

hours, and provide for their families without the constant worry of unreliable care. This

investment pays off in the long run—producing a healthier economy, a stronger

workforce, and greater opportunities for Ohio’s youngest learners.

To ensure this investment is effective, we must also support program compliance

measures that prioritize families' needs while strengthening the capacity of child care

programs. We support the additional child care system improvements required by the

federal government included in HB 96.

In addition to expanding child care assistance, we must also enact a refundable Child

Tax Credit to help working families keep more of their hard-earned money. Voters

understand that when families can afford the basics, they work more, earn more, and

contribute more to Ohio’s economy. Ohioans overwhelmingly agree: families need

relief, and the Child Tax Credit is a solution that works. A staggering 84% of Ohio

voters support a Child Tax Credit, including 83% of Republicans, 78% of

Independents, and 94% of Democrats. That support only grows—to 87%—when voters

learned that both President Trump and the former president have backed expanding

the Child Tax Credit. We don’t see bipartisan consensus like this often, especially in

today’s political climate. This is a unique moment for Ohio to take action on a policy

that truly unites voters and working families across the political spectrum.

A Child Tax Credit ensures that work pays for Ohio families. It incentivizes parents to

stay in the workforce, reduces financial stress, and allows families to invest in their

children’s futures. Studies have consistently shown that when families receive this kind

of targeted tax relief, they spend it on essential goods and services—groceries, rent,

child care—directly stimulating the local economy and supporting small businesses.

This is Ohio’s moment to act. By expanding publicly funded child care and the Child

Care Choice Voucher program to serve families up to 200% of the Federal Poverty Level and enacting a refundable Child Tax Credit, we can remove barriers that keep parents out of the workforce, strengthen our economy, and ensure Ohio remains a great place to live, work, and raise a family. These are policies that reward work, reduce dependency, and promote the growth of our youngest children and the economy. Supporting Ohio’s youngest children is not just the right thing to do—it’s the smart thing to do for our state’s future.

Finally, we support other key programming proposed by the Department of

Children and Youth in HB 96, which provides further critical support for young

children and families including, but not limited to, the following:

Investments to scale community impact models like Cradle Cincinnati to encourage collaboration between women, clinicians, hospitals, managed care and other community partners to reduce infant and maternal mortality.

Increased access to evidence-based home visiting programs including scaling of the Family Connects model statewide.

Increased state investment in Early Intervention (Part C) to ensure timely evaluations, assessments, and service coordination for infants and toddlers with developmental delays.

Expanded access to evidence-based early literacy initiatives, including curricula grounded in the science of reading and the Dolly Parton Imagination Library of Ohio.

Investing in these initiatives ensures Ohio’s babies have access to the care and

resources they need to survive and thrive, strengthening our communities and our

economy for generations to come.

Thank you for your time, and I welcome any questions you may have.

Attached to this testimony is a copy of the polling memo that is the source for all poll

data used in this testimony. To view additional polling data, visit

Also attached to this testimony is a summary of the impact of the proposed child tax

credit proposed in House Bill 96 from the Prenatal-to-Three Policy Impact Center at

Vanderbilt University and excerpts from the Columbus Dispatch dated March 2, 2025. Click here to view.

To learn more about the needs of young children and families, view Groundwork